Hi everyone,

My favorite editor Lindsey has a new newsletter! She’s the OG creator of the Money Diaries and all around good person, so give it a read if you’re looking for more (actually interesting) financial content.

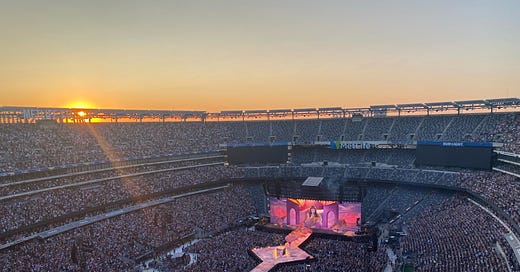

As for me, I had the time of my life at the Eras tour, pictured above. I somehow got chosen for the presale and made it through to score tickets for $100 each, but I admire these ladies for trying to make sure others can enjoy the concert for a reasonable price (I considered buying tickets for a second day and they were all over $1,000, including those with partial views). T Swift’s tour is really highlighting how awful the ticket-buying experience has become in the U.S.

I’ve also written a few stories on the financial troubles of millennials (according to some vocal readers, this makes me “whats [sic] wrong with journalism”), as well as stories about the end of the federal student loan payment pause, 20-somethings who are happy living with their parents, how a 31-year-old manages 80 credit cards, and the budgets of a bunch of high-earning 20 and 30-somethings.

In this week’s issue:

1. The way we work now

2. Federal student loan payments are coming back

3. Links

The way we work now

More than three years after the first Covid-related stay-at-home orders, and the WSJ is wondering: why do people like to work remotely, anyway?

I had to laugh when I saw the headline because…is it not obvious. But I’ve written my fair share of “obvious” stories that are intended to give a voice to real people, as that story does, so I get it. I personally love working from home, and think a lot of the reasons given for “returning to the office” don’t always pass muster. That said, I do think there are benefits to working in person in the same space some of the time: getting to know coworkers better, learning new skills/the ropes from older workers, more structure, and so on. Of course, big pronouncements about the benefits of “collaboration” and “training” are great, if companies actually follow through and foster the type of environment in which those things can flourish. (Three years is not quite long enough to completely memory-hole the banality of office life.)

This is a fascinating time to write/think about the future of work. Covid really broke something (well, many things), and we still don’t know the end result of that. It will be years until we have a clear picture. What’s more, these conversations are, at least to me, pretty interesting. It’s interesting to reimagine what we could do with vacant office buildings. It’s interesting to reconceptualize our relationship to work and careers. Plugging your ears and refusing to acknowledge that things could be different is the wrong move, imo.

All of that said, we do seem to be shifting back to pre-Covid work mentalities. The guy who coined the term “Great Resignation” says it’s over now, which is pretty obvious. People are holding onto their jobs for fear of layoffs, or sort of settling into the post-Covid work life; we crave stability. For all of my love of remote work, I’m not actually convinced it’s here to stay, at least not for a sizable portion of the workforce. It might be interesting to reimagine what our lives could look like, but business just wants to get back to regularly scheduled programming.

Federal student loan payments are (almost) back y’all

After 3+ years, federal student loan payments and interest accrual will restart in the fall. It was always going to happen, but with President Biden repeatedly extending the payment pause, it wasn’t too crazy to think he just might do it again—especially if his forgiveness plan is blocked by the Supreme Court. Alas, that was not meant to be. Come September, the student loan pause will officially be dead.

Quantifying the payment pause’s effects on borrowers/the economy is next to impossible. Individuals saved a lot of money over the past three years, not just by not having to make monthly payments (which average $400 a month but can be much, much higher), but also in interest, the real killer. Depending on your balance, you could have saved tens of thousands of dollars over the past three years, with the 0% interest rate.

And then there are all of the other things borrowers were able to do when they didn’t have those payments:

Finally start saving in an emergency fund (and even earn a little interest on that savings, at least for the past year or so)

Pay off other debt (saving them even more on interest)

Focus on paying down their private loans

Build credit scores

Buy a house (the dividends from that will last a lifetime)

Pay for a wedding…

…and on and on and on. As one borrower told me, it feels like it’s been a “three year blip” that’s been incredibly helpful to, oh, 40 million people. (That said, there is research on some of these borrowers taking on other forms of debt, putting them in a worse position.)

Now that is coming to an end. I find the economic data right now hard to square. We’re not in a recession (maybe?), the unemployment rate is any president’s dream, we continue to add jobs each month. Yet there’s no doubt that many households are struggling. People are cutting back on spening, steeling themselves for layoffs, accruing more credit card debt, etc. Adding another multi-hundred- (if not thousand) dollar bill back on top of that isn’t going to make the vibes any better.

And if you were wondering what’s going on with student loan forgiveness…well, we’re still waiting to hear from the Supreme Court. But three Senate Democrats broke with their party last week to vote with Republicans to block the relief plan (Biden vetoed). So that’s not a positive development for those hoping for widespread relief.

A lot of proponents of student debt cancelation are mad at how Biden went about it. “He can just do it! He’s the president!” But the fact that these three Democrats voted to block the program should signify what an uphill battle this is and will continue to be: Congress—the branch of government that can pretty indisputably enact this type of relief—isn’t gonna do it, not in its current configuration. A president can only do so much (especially with a Supreme Court that so heavily leans in the other ideological direction).

So, we wait. It does make me wonder if there’s ever been this sort of financial promise/aid from the government that’s been taken back (opposition to the Affordable Care Act rings closest to me, in terms of scale)? Would love to hear from people who know about these things.

Links

I recently joined a hot yoga studio and have been going a few times a week. The thing is, I’m terrible at it. I have to take breaks, I lose my balance, I don’t even attempt the advanced poses. But I’ve also been enjoying the challenge, and reveling in small improvements (like not being quite as wobbly transitioning into Warrior III). I was reminded of that as I read this: “It is hard to escape the voice of efficiency and winning to an extreme. I’m not only afraid of taking risks; I’m afraid of valuing things that do not clearly communicate that I intend to WIN. We can’t just take a walk. We have to hike. We don’t play a game of horse. We join a league. We don’t merely knit. We set up an Etsy shop. Having an end goal for everything I do has had an unintended effect on my choices: It has started to narrow my vision of what’s possible to things that I think I can win at doing. This is why I experiment with living life outside of optimization…[and] finding joy in doing things I am not very good at doing at all.”

How to ignite and foster creativity.

Broaden this out and it applies to a lot more than Tiktok. The vibes are not good.

“It’s absolutely conceivable that the streaming subscription model is the crypto of the entertainment business.”

There are too many modes of communication at work. And in life, tbh. That is one of my worries with this newsletter — who needs one more platform to check? What am I saying here that’s different from what I’m saying anywhere else (or any other reporter is saying anywhere else)? Idk. I’m still trying to figure out.

“Workers are seeing that unless they work together to fight back, institutions will grind them to dust.” Please don’t call my job a calling.

That’s it for now. Have a great week,

A

P.S. If you know someone who would like this newsletter, please forward it along!

P.S.S. Thanks Christopher Skinner for the illustrations!